3 Weeks ago, I took a sales job to help keep me going while I continue to bootstrap my start-up company. Sure I still make a little money from my Multi-Level-Marketing company, but not nearly enough to live off of and definitely not enough to take any kind of Mini-Retirement Vacations. I have never been an advocate of full-time multi-level-marketing anyway, that is NOT the model! A good MLM company gives the person who has a day job the ability to add income and then after about 18-36 months produces enough income to replace what ever that person was making at their job. This idea of being a full-time networker with no experience in that space is a bad idea, you will most likely run out of money and burn through your savings before you get profitable forcing you to go back to your job with your hat in hand. Trust me, I know, I’ve made that mistake before.

All to many times I see people jump from company to company trying to “Find the right one” and that is just a bad way to go about. Do I believe in MLM? Yes, from the bottom of my heart, but I don’t believe that putting all of your eggs in to one basket in life is ever the correct path.

I think the correct path should look something like this, and keep in mind, it doesn’t matter how young or old you are, this still applies.

- 1. Preparation – Get a money plan for any and all income, if you a 1099 guy like myself here is what I use for all income……

- – Say I make $10,000 from work, investment, play what ever

- – 20% ($2,000) – Goes to interest bearing savings account for Taxes

- – of the 8K left it gets divided as follows

- – 50% (4K) for living expenses i.e. Rent, mortgage, gas, food, travel etc.

- – 20% ($1,600) Savings / Retirement / Long-Term-investments

- – 10% ($800) – Education i.e. books, audios, personal development/investing seminars etc.

- – 10% ($800) – Big ticket item saving i.e. new car, toys, vacations etc.

- – 10% ($800) – Play fund money to spend on what ever I want, when it’s gone, I’m done playing

- – If you have debt to pay off, take 20% off the top before you adjust for Education, Big ticket items and play fund. Put it towards your highest interest debts 1st eliminating any all debt

- 2. Job – Income coming in on a weekly/bi-Monthly basis (30-40 hours a week / 3-10k per month)

- 3. Find the balance – Mind, Body, Soul, Relationships, Pocketbook. If these aren’t in balance, the next steps wont matter because you will never get there.

- 4. First 2nd Stream of income w/ little to no investment – This can be an MLM or a side business like flipping cars or selling stuff on eBay. This should make you money fairly quick, and the start-up cost should be small. A couple thousand dollars that you will see a return on in a couple of months. Any proceeds from the business.

- 5. Do Something Your Passionate about that Makes Money! – This could be from a side job you started or something that you always wanted to do. With enough money coming in and savings in the back subsidized with side income you now bought yourself the freedom to quit your job and find something that you’d much rather do.

- 6. Deals – Once you have conquered all of these areas, then it’s time for you to graduate from Owner to Deal maker, meaning that by now, making money has become easy to you, it’s no longer emotional and trivial, it jut is. When you get there, and you will know when you do, then life becomes more about the challenge instead of making money to survive.

Now, if at any point, you get knocked on your ass which you will, you simply start the steps over. It is what I am doing in my life right now, what I’ve done in the past and what  I will do in the future. Why, because none of my financial decisions are based on emotion, if they are, you’re losing at the money game. Even when I’m down, I still strive to make logical decisions when it comes to money. That kind of delayed gratification is what allows wealthy-minded people to stay rich, and poor-minded people to continue to stay poor or loose you wealth. If you are anything like me, you will find that you become much more resilient to the ass kickings life throws at you once you have been through a couple of them. For me, it’s never about how hard I fall or what I lose, it’s all about how quickly I can get back up. This time around, I didn’t lose much as I was 10 times more subsidized and protected than I was when I went through some similar circumstances at the age of 23. I predict it will take me less than 6 months to clear all debts, and be in a cash flow positive situation traveling around the world by the end of 2014.

I will do in the future. Why, because none of my financial decisions are based on emotion, if they are, you’re losing at the money game. Even when I’m down, I still strive to make logical decisions when it comes to money. That kind of delayed gratification is what allows wealthy-minded people to stay rich, and poor-minded people to continue to stay poor or loose you wealth. If you are anything like me, you will find that you become much more resilient to the ass kickings life throws at you once you have been through a couple of them. For me, it’s never about how hard I fall or what I lose, it’s all about how quickly I can get back up. This time around, I didn’t lose much as I was 10 times more subsidized and protected than I was when I went through some similar circumstances at the age of 23. I predict it will take me less than 6 months to clear all debts, and be in a cash flow positive situation traveling around the world by the end of 2014.

How am I so sure? Great question. Let me ask you this, if you were 23 years old and woke up one day and found out you were all of sudden $160,000 in debt, what would you do? If you make 50k a year, you would be shitting bricks. What if I gave you the same scenario, but you made $190,000 a year before. Probably not so bad right? Ok set that aside for a second and let’s assume that you have been in debt most of your young adult like I was and like most Americas are. We’re conditioned from a young age that it is ok to live like this. This is why you get credit card applications in the mail @ 18 years old and high schools, colleges and employers never even teach the most basic of finance. “The Man” i.e. your boss, the government (IRS especially), super rich people and the owners of banks and lending institutions etc. don’t want you to figure this out. They want you broke, tired, hungry and pre-occupied with shit that doesn’t matter like video games, American Idol, and spectator sports so that you are not paying attention to the fact that they are ROBBING you blind. If you don’t believe me, enjoy this video.

httpvh://www.youtube.com/watch?v=QPKKQnijnsM

Debt, should be used as a tool, not as a way to get instant gratification to buy yourself things that you cannot afford, or even need in most cases for that matter. With the exception of college loans (Which I think is another racket anyway) you shouldn’t have any debt unless you own a business that produces income, or own a home. The fact that no one ever told you that you shouldn’t be in debt isn’t really an excuse and if it is, I’m telling you now. Don’t worry, it’s not like our country leads by example, they’re 16 trillion in debt, so don’t worry about them, because policy isn’t going to fix our problems here on the ground right now today as it pertains to you and your family or future family.

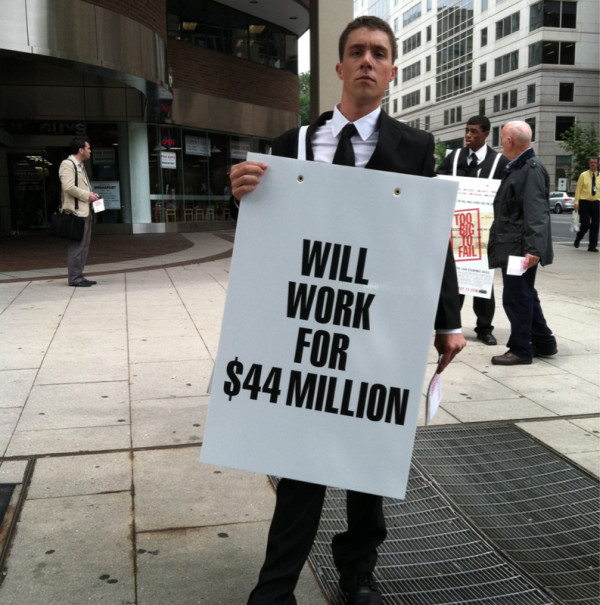

The point is that all those institutions make money off of our continued ignorance. Why does everyone hate them? Simple, because they’re smarter than us and no matter what recession we go through, the good people at Goldman Sachs or in Congress don’t seem to mind all that much our struggles doesn’t affect them. While were slaving away everyday trying to collect their scraps going to work every day to run on the mouse wheel they are taking million dollar bonuses from our bail out money and buying yachts. Do I not believe in Capitalism? Of course I do, and in order to achieve the types of results that they have been able to achieve you simply must understand their game.

The point is that all those institutions make money off of our continued ignorance. Why does everyone hate them? Simple, because they’re smarter than us and no matter what recession we go through, the good people at Goldman Sachs or in Congress don’t seem to mind all that much our struggles doesn’t affect them. While were slaving away everyday trying to collect their scraps going to work every day to run on the mouse wheel they are taking million dollar bonuses from our bail out money and buying yachts. Do I not believe in Capitalism? Of course I do, and in order to achieve the types of results that they have been able to achieve you simply must understand their game.

Solution: Stop borrowing money. If a bank sells money, and we’re not buying it, the bank can’t make money. If we bought houses cash, we wouldn’t need a mortgage. If we cut up our credit cards, we could only spend what we had incurring no negative interest. If we took a job we didn’t like as a means to buy us some time to find something better, then we would all be doing things we liked and wouldn’t get stuck in the rat race. If we were always educating ourselves with the same materials the richest people in the world did, wouldn’t that level the playing field a bit? If we could all wrap our heads around this idea of delayed gratification, wouldn’t we become less impressionable to consumerism thus driving all prices of consumer goods down substantially because fewer people are “willing” to buy.

Ask yourself, do you really need a new car every year? Do you feel so left out because you don’t know who won the game on Sunday? Would it kill you to watch a little less TV and maybe read a book? Don’t you think you were put on this earth for more of a purpose than running on the hamster wheel, getting your food pellet, drinking water, playing a video game and getting back to running on the wheel again?

So lets start moving in the right direction, let’s stop trying to look good and actually do good. Nothing makes me happier than seeing my friends, and people I love find themselves in life and achieve great success. So much to the point that I have dedicated a large part of my own life to help people do just that. The help is there for those who seek. I sought it out when I was young and it got me to where I am today. As it turns out, all the successful people I met growing up were happy to help guide because they saw my willingness to learn and the way I sought out enlightenment. Let’s stop lying to ourselves and get honest with each other about where we a really at now, and get very clear on finding just what our real purpose is here in this life.

So if you have a Job, work your ass off at it, find something you actually love doing and then get out of there before you forget your dreams. There are no shortcuts in life that lead to the top of the mountain, you’re going to have to climb it, and the first time is always the hardest and scariest. I know because I have tried a couple of shortcuts while climbing the mountain and they always led back to the hamster wheel. The irony is that once you master that mountain and you can afford to buy a helicopter to fly to the top, it doesn’t seem all that hard to climb anymore anyway 😉

So if you have a Job, work your ass off at it, find something you actually love doing and then get out of there before you forget your dreams. There are no shortcuts in life that lead to the top of the mountain, you’re going to have to climb it, and the first time is always the hardest and scariest. I know because I have tried a couple of shortcuts while climbing the mountain and they always led back to the hamster wheel. The irony is that once you master that mountain and you can afford to buy a helicopter to fly to the top, it doesn’t seem all that hard to climb anymore anyway 😉

I wish you the best of luck out there, and take it because you’ll need it.

-Steve