by Steve Wolf | Oct 13, 2016 | Business, Lifestyle, Money

I wrote a previous blog on money management where I shared some tips on how to identify where you are wasting money and then gave my own personal formula (via an downloadable excel spreadsheet found here) the gauge all of your spending. If you are coming from that blog, then you are in the right place. If you are just looking at this blog for the first time, it may be prudent to go back and check out the previous one I wrote or at least download the excel spreadsheet because you will need it for the next step.

Step 2 – Formulating a simple budget that you will actually follow.

It was told to me early on in life by a very wealthy mentor of mine who I respect dearly that if I couldn’t manage $1, then I couldn’t manage $1 Million dollars. This is so true, I meet people all the time who’s personal finances are garbage even when they are making great money in their career.

It all comes down to money management and budgeting. Again, this is another common thread among all wealthy people I have ever met; they all have a budget based on a formula that uses money as a tool never spending it emotionally. Here is what to do.

Take that excel spreadsheet you just downloaded. (or get it here)

The idea here is very simple. Manage any and all money that you get. EVERY SINGLE CENT! If you know what your monthly income is, it becomes very easy to budget, if you are like me and get paid in lump sums sporadically then disciplining yourself to a system like this is crucial!

Ok so here is how it works: For every dollar I take in, it gets split up and put in to different bank accounts. Each bank account represents a different aspect that I am saving for. In my case I have 8 Bank accounts. I explain what I use them for and the benefits.

- Wells Fargo Checking / Savings account – This account is used for daily spending, and paying bills. Think of it as your most active account, all money is deposited here before it goes to other accounts.

For daily spending and bill payment, I like Wells Fargo. The important thing to remember here is to bank with a bank that is convenient to for you with lots of locations and low fees across the board. As of right now, I pay NO FEES with Wells. I think B of A is the worst, and Chase Bank is in the middle when it comes to big banks.

- Discover Bank # 1 – Taxes (This is where I said aside money for taxes every year)

- Discover Bank # 2 – Emergency Fund account (Save for a rainy day)

- Discover Bank # 3 – Long Term Savings (Use for large purchases like a house or car etc.)

I use Discover bank because they give you the highest rate of return for a savings account. 0.95% to be exact and…

- No minimum deposits

- No Account Fees

- Open as many accounts as you want

- Capital One 360 # 1 – Annual Expenses account (Money set aside for annual expenses like car insurance, property tax etc.)

- Capital One 360 # 2 – Vacation Fund (Saved money for Vacations)

I use Capital One 360 because they pay a pretty good rate of return on money in savings and my account doubles over as my top pick for a travel debit card that has

- No minimum deposits

- No Account Fees

- Open as many accounts as you want

- NO foreign transaction fees

- No ATM banking fees.

(If you are interested in opening up a Capital1 360 Account and want $20 for free just for doing so, click this link.)

- Wealthfront Account – Managed Portfolio Long term investing account

(Click here to learn about wealth front and why I recommend them. Clicking this link will get your first$15,000 managed for FREE!!)

- FXCM Account – This is my active foreign currency trading account as I trade currencies daily. If your are interested in learning how to trade I wrote a blog about it here, otherwise, dedicate the 5% I am setting aside in this account to some other find or investment.

Now take some time to look it over the excel spreadsheet. If you need to open a couple accounts, don’t worry, this can literally be accomplished in an hour, follow the links above to use my recommendations, or feel free to open up accounts where your want to.

Keep in mind that I am a 1099 independent contractor that means I pay my own income taxes each year. If you are a W-2 employee, then you can zero out the taxes line because your taxes are collected before you get paid. Personally I set aside 18%-20% a year for myself, you may pay less or more depending on how much you make and what your tax liabilities look like.

- Enter all of your monthly and annual expenses. (You will see some numbers starting to populate)

- Replace my bank accounts with your banks and match them closely as possible, meaning if you have a normal B of A or Chase Checking and savings account, that should be your main account at the top. If you have an E*TRADE, Schwab or IRA, replace my Wealthfront account with yours etc.

- If there are some areas where you will need to set up new bank account, leave them blank for now

- Now enter in your monthly income at the top in the yellow (total monthly Colum)

- By now you should see some of the boxes populating. I will explain what’s happening here

The Breakdown.

Ok by now you probably have a good idea of what I am driving at here, but I will explain anyway. This formula is partitioning all of your income into different savings columns to give you a well rounded and financially savvy money management system.

The breakdown as seen in my excel sheet looks like this.

- I earn $100

- $20 (20%) is saved for taxes and taken right off the top (Skip step if you are a W-2 employee)

- Now I have $80 Left

- $40 (50%) Goes to my living expenses, i.e. rent, mortgage, car payment, food, gas etc.

- $10 (10%) – To the emergency fund, after all shit happens.

- $10 (10%) – Long-term savings fund. This could be for a future large purchase like a car or house down payment.

- $8 (8%) – Annual Expenses Account – Like car registration or medical/life insurance. Things that get paid once per year

- $7 (7%) – Vacation Fund – To broke to take a vacation, do this for a year, and I promise you that you will have enough to take a vacay!

- $10 (10%) – Long-term investment account – YOU NEVER TOUCH THIS MONEY! This is for your retirement. You may be thinking I’m way to young to start saving for retirement, but the difference between starting this habit at 20 years old compared to 30 years old will mean a difference of hundreds, yes I said hundreds of thousands by the time your retire. So don’t fuck around with this one, set the 10% aside and forget about it.

- $5 (5%) – For me it goes to an active trading account that I personally trade. If you have no desire to learn how to actively trade, you can simply put this money towards some other kind of investment short term to medium term, but this money is not for bullshit, it’s money set aside for short-Medium term investments with a bigger return on the short side.

Conclusion

This whole idea was adopted after first reading the age old book The Richest Man in Babylon. When done correctly you will learn to pay yourself first and then save and invest the rest of it leaving a little hear and there for having a good quality of life.

My parents generation saved about 20%-30% of there income on average. My generation saves a measly 5%-10% and knowing that we are going to need a least a cool million to retire on (4 times as much as my parents will need) we need to get on this today. There is literally no time to waste.

Again, if you are in debt, or not making a lot of money, apply this formula anyway. Rework the numbers to make them fit your situation. If you are in some serious debt, check out my blog on &^%&^%&*^%&* if you are just not making that much or spend money stupidly, then I challenge you to try this for 90 days. If after 90 days you don’t feel like you have a better handle on your finances and that you are heading in the right direction, comment here and I will jump out of an airplane to promote what ever you want me to.

Money is a tool. It is only emotional when you don’t have enough of it. It controls you, or you control it, simple as that.

****And as a bonus, if you are still not convinced, Acorns is a nifty little app that allows you to invest pocket change from rounded up expenditure in to the market as a long term investment. Follow this link to check it out and get $5 for opening an account.

Did you mis part 1 of this blog? Read it here!

by Steve Wolf | Oct 13, 2016 | Lifestyle, Money

I have written many blogs on personal finance, today I am going to speak specifically about investing, but not investing from the standpoint of a 40-something somewhat wealthy person with savings in the bank, a house and a stable career he or she has been in for over a decade.

This blog is aimed towards Millennials. If you a person age 18 to 34 then listen close because applying the small techniques that I am going to share in this blog could mean the difference between your financial success and failure later on in life.

Before I get in to the Nitti gritty of this, I want you to know that if you feel like you are broke at the end of each month, living paycheck to paycheck or simply just not making enough to meet your monthly nut and save a little bit at the end of each month then this blog is for you.

You could also be one of the thousands of recently graduated college students on the job hunt drowning in school loan debt wondering how you are ever going to get ahead.

Or, maybe you are doing ok financially and you are just looking for more ways to become savvier with your money.

Whatever category you fit in, what I am about to share is going to help you tremendously! Enough said, lets jump in to it.

Step 1 Gauging where you are.

I have never met a wealthy person who did not know where they were at financially. People who have built real wealth have some type of formula they use to save, invest, pay taxes and to live. This has been one constant that I have experienced with every wealthy person I have met that didn’t inherit the money or get lucky.

What you need to do is figure out where all your money is going. I think you would be surprised to find out that you probably waste about $20 a day on bullshit. What I mean is you may have a daily Starbucks Frappuccino habit, or maybe you never cook at home and eat out 3 times a day. What ever it is everyone has their vices and they are costing you greatly.

So, first thing is first, write down all of your expenses. Everything. From monthly fixed expenses like Rent, mortgage payments, car payments utilities etc. right down to your varying miscellaneous expenses. This will allow you to see where all of your money is going.

Remember we cannot fix a problem until we can recognize there is one, and this is going to help you gauge where you are at financially.

In part 2, I am going to share with you the simplest budget you have ever seen that anyone can follow even if you think you are to broke to save. In fact, I am going to share with you my own personal excel document that you can use to do this exercise.

by Steve Wolf | Jun 28, 2016 | Business, Money, Travel

It is not everyday that you really get to feel all of your hard work pay off. When I started currency trading 3 years ago, it was hard. There was a learning curve, and at times it seemed daunting and elusive to actually be successful at trading.

I really believe that when attempting anything new, there is going to be a period of time where you just suck at it. When you are a person who really likes to win, it can be difficult to attempt new things. The trick is that you simply need to accept the fact that you are a rookie, a noob, a kook or whatever and that you are not going to be killing it one month out of the gate.

Trading currencies has been a game changer for me. Coming from the sales and marketing world, investing in general seemed to be for brainiac types who were really good at numbers. I knew that I could always make money in a situation where there was something to sell, but could i have the same success as an investor, or as a FOREX Trader?

When I first found the Forex market I was vacationing in Bali Indonesia on a surf trip. On a day where there wasn’t any surf to be had, I started looking for ways to make money from a laptop…. (Watch the video, it will explain the rest so I can get on with my story)

Once I found the market and made my first couple hundred dollars before the sun came up one random morning, I was hooked! Unfortunately I never took in to consideration that in order to win at trading, you are going to take losses, and I was a guy who didn’t like to lose. I proceeded down a losing spiral of lost profits and nearly decimated my entire trading account in less then a months time.

I took a break from trading and was feeling pretty beat up by the market. Losing can really screw with you when catch a bad streak like I did. I was not prepared for the emotional turmoil that ensued. Unlike anything I had attempted before, currency trading required me do adopt a high level of emotional intelligence in order to be successful at it. So I got back up, dusted myself off, and got back to it.

I went back to the school where I had originally learned how to trade. I went through the course again with no expectations and a new willingness to learn.

The curriculum didn’t change, my perspective did. This time around, I was a lot more humble. After all I got my ass kicked. After putting in 6 months of hard work in, I starting to see some positive results in the form of substantial equity growth in my account. I was ready to take the show on the road, and see if I could really do this from anywhere in the world.

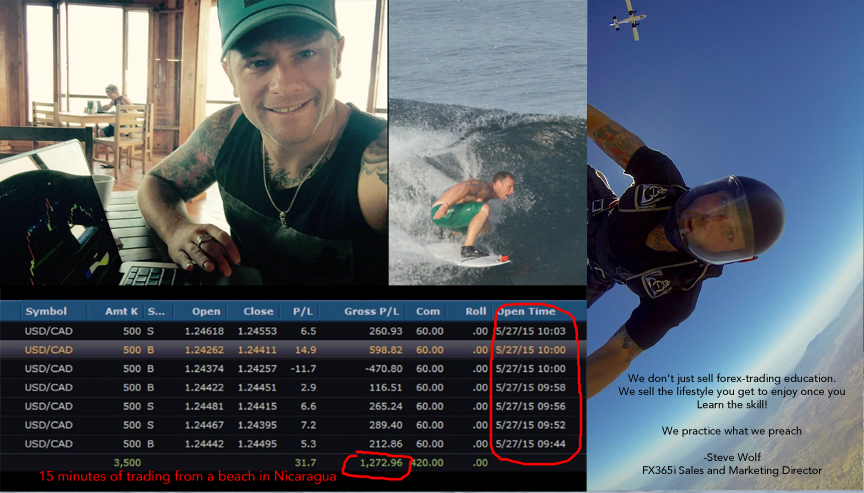

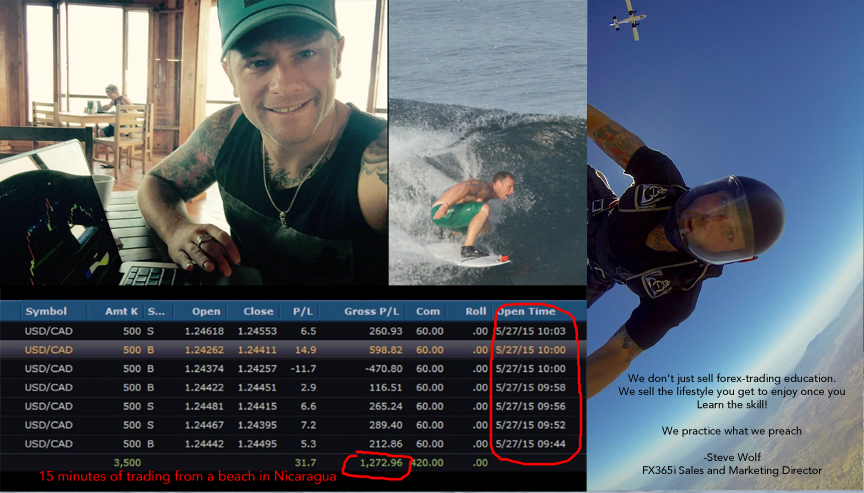

I headed down to Nicaragua with my girlfriend with 3 goals in mind:

- Propose to my girlfriend

- Surf some big waves

- Pay for the whole trip currency trading from my laptop

I scored big time. The surf was macking, and I was pretty sure my girlfriend was going to say yes to marrying me. I was just waiting for the right moment to propose. I started doing my pre-sessions & technical analysis on the market looking for some trades one morning, and then just like that, a couple trade set ups presented themselves and I pulled the trigger!

— I was sitting in a youth hostel using their shotty wifi and hoping to God that the internet did not go out before I closed my trades. With in 15 minutes of trading I managed to pull 7 scalped trades netting me $1,272.96 after commissions. —

I closed my laptop, ordered an iced coffee and just sat for 10 minutes staring at the ocean and feeling like I had just pulled off a huge victory! I soaked it up, I proved  that not only could I trade, but I could do it from a shitty hostel with bad wifi in Central America. Later that evening, I asked my girlfriend to marry me and she said yes.

that not only could I trade, but I could do it from a shitty hostel with bad wifi in Central America. Later that evening, I asked my girlfriend to marry me and she said yes.

So I got 2 out of 3 of my goals done. Even though $1,300 was not enough to cover the entire trip, I felt like $1,300 for 15 minutes of my time was well worth taking the rest of the trip for myself and to celebrate my new engagement. Besides, the surf was macking remember!

The moral of the story is that If you put your mind to something and stick with it, you can do it. The path to success is not linear, but it follows a trend!

If you want to know more about how you can become a currency trader and make profits in the market from a lap top anywhere in the world click the logo below and find out more about the FX365 Institute!

by Steve Wolf | Aug 7, 2014 | Business, Lifestyle, Mental, Money

2014 has been tumultuous year for a lot of people including myself. There are so many problems in the world here and abroad that it can be hard to simply focus on the task(s) at hand. It is easy to get caught up in unproductive actions when you have idle time and no new prospects on the horizon. Low productivity and a lack of results can become a habit-forming sickness if you let it.

After life throws a couple proverbial kicks in the balls or as I like to say “shit sandwiches” at you, it can kill your confidence. In fact, you may have long streak of bad luck, or a shitty set of circumstances that has led you to the point of disparity. These “tests” are simply life experience that will allow you to build character, and although I would never wish bad things upon my fellow-man, shit happens and that’s life, so you are going to have to deal with it whether you like it or not.

So what to you do?

There are many ways to deal with shitty life circumstances, but really when you get right down two it, most people’s lives boil down to either of these scenarios:

1) Not enough money, too much time.

2) To much time, not enough money.

In my 30 years here on planet earth, I have seen and experienced a lot of people, places and things. Very little actually shocks or surprises me these days and that’s a good thing because I am not looking to be shocked or surprised. Instead, these days I’m looking for security, successful relationships and a long and vibrant life. When I have wound up in one or more of these scenarios over the years I would spin out really quick.

The best years I had making money were the years my personal relationships suffered the most, mainly because work came before everything else, and if there was work to be done, you weren’t important. This is no way to live unless you want to be a fat, bald, divorced rich guy who dates 22-year-olds in his late 40’s.

My worst years financially were the years that I grew the most as a human being. I found compassion and empathy for people who struggle that I never understood until I went through it. I made my best friends in life during those hard time and I believe it is due to the fact that when you have no material things to offer someone, then all you have to give is your friendship, loyalty and honor . To me those ideals are so much more important than money when it comes to who I associate with, and more importantly who I trust. It took me losing almost everything at 23 years old to realize it.

Finding the balance is always the hardest thing to do. I am a strict believer that those with the ability to reason (Homo Sapiens) have the hardest time living in a natural state. I’ll give you an example why:

Birds migrate to move from areas of low or decreasing resources to areas of high or increasing resources. The two primary resources being sought are food and nesting locations. If one of the birds had the ability to reason, he would negotiate renting a warm barn in the winter and find a way to store enough supplies to last him and his family the winter saving him and his family the burdensome task of flying several thousands of miles twice a year. The Birds brain does not allow for reasoning of this kind, in fact the bird couldn’t really even explain why it migrates, it just knows, as if nature set it up that way. If birds simply stopped migrating they would surely die by way of extreme weather and shortage of food.

You see, the ability to reason is a gift and a curse. If used properly and efficiently, a human can go on to live an extraordinary life but unfortunately this is not the case for most of us, and if you don’t believe me, take a stroll down your Facebook news feed and bask in sea of useless time wasting shit that gets posted on a daily basis. I know this because I have found myself getting sucked in to some stupid video and then next thing I know I lost an hour of my day looking at clip after clip of useless things that do not benefit my life in one way shape or form.

If the world was in perfect balance, there would no wars, no poor people, no suffering. On the flip side of that, If there were perfect balance you would not be allotted the opportunity to choose what type of life you want to live. In a basic sense, human nature as we know it is constant tug-o-war between what we really are, who we think we are, and what we want to become. Personally I find the most serenity in being comfortable and grateful for who I am now, and what I have now while always striving to better myself, and my situation. You can’t change the past, and you cannot tell the future so hope for the best but always plan for a worst case scenario situation.

The truth is that any person possess the ability to spend their time being and doing productive things in life regardless of any one or multiple situations. You do not need to be rich to be happy, you need to understand what kind of life you want and then live it, that’s the key.

So if you are currently in a situation like I wrote about above, I have put together a little matrix that may help you understand how to find balance and make some sense out of what I am trying to convey.

As you can see from my highly complex academic chart, if you work too much and spend a lot of time doing shit you don’t like doing, then you are going to be unhappy. If you strive for a good to great balance between work and play, then you are going to be a much happier person. The perfect balance does not exist, so stop being a perfectionist and strive for something obtainable. Come on, it’s not f%*&^& rocket science!

Tips and Tricks

Here is what you can do when you have To much money and not enough time.

- INVEST and SAVE. How do you think the top 2% did it. The easiest way to make money and spend less time working is by making your money work for you, so when it’s rolling in, get it while you can, but then invest and save it for the times in life when there is little or no money coming in.

- Plan time for loved ones even when it’s going to cost you! Don’t make the mistake of sacrificing opportunities to build memories with friends and family chasing the dollar. My mentor Mike W. told me on his death-bed “Steve, I’m not dying in this bed thinking of all the missed opportunities in life where I could have made more money, instead I’m lying here in utter gratitude that my life allowed me the opportunity to spend a lot of time with the ones I loved and my livelihood allowed for us to have enough money to be happy.” I’ve never heard it better put than that.

- Try to Automate the system, meaning same or more income, less of you needing to be at your “job”. Read the “4 Hour Work Week” by Timothy Ferris, it will lay some insight in how to go about this.

- Continue to look for opportunities that will allow you to get more of your time back with the same or more amount of income, trust me, it’s very possible!

Now, lets talk about what to do when you are in the opposite side of the situation: To much time, not enough money.

- Survival Mode, this means that because of the lack of income, you cannot be stupid with money. You need to make it last but do it so but keeping the quality of your life intact as much as possible.

- Use this as an opportunity to work on yourself, your mind, your body and spirit. Go to the GYM, go do some Yoga, go SURFING, don’t waste the time playing video games or staring at Facebook for 6 hours a day. If you have some time, go use it to your advantage, and go do some of the things that your job never allowed you to do!

- Look for work, and don’t be prideful. If it got bad enough for me, I would go dig ditches, get unemployment, and what ever I needed to sustain the quality of life that I have even if it meant doing work that I feel is below me or take government subsidies until I’m back up on my feet.

- DO NOT GO IN TO DEBT! Never ever ever ever ever put things on credit or take out loans with out a solid plan of getting out of that debt. If you have to live on credit to sustain your lifestyle, than you are living beyond your means and you need to cut the fat, don’t be prideful, you can buy that new car next year when you get that job and can pay cash.

- Don’t get depressed. It’s not the end of the world, opportunities find their way to people who are looking for them. Even a broken clock is right twice a day, and I am sure that you are not a broken clock, so don’t let the bad times get you down, just embrace them, accept it and move on diligently.

Enjoy the rest of the Week.

Happy Thursday, The weekend is almost here!!!!!!!!!!!!!

that not only could I trade, but I could do it from a shitty hostel with bad wifi in Central America. Later that evening, I asked my girlfriend to marry me and she said yes.

that not only could I trade, but I could do it from a shitty hostel with bad wifi in Central America. Later that evening, I asked my girlfriend to marry me and she said yes.