Blog

What digital transformation means for brands

Business in the modern age is seismically different compared with even five years ago. Businesses have been profoundly changed by the influx of digital-based processes and systems required to work...

by Steve Wolf

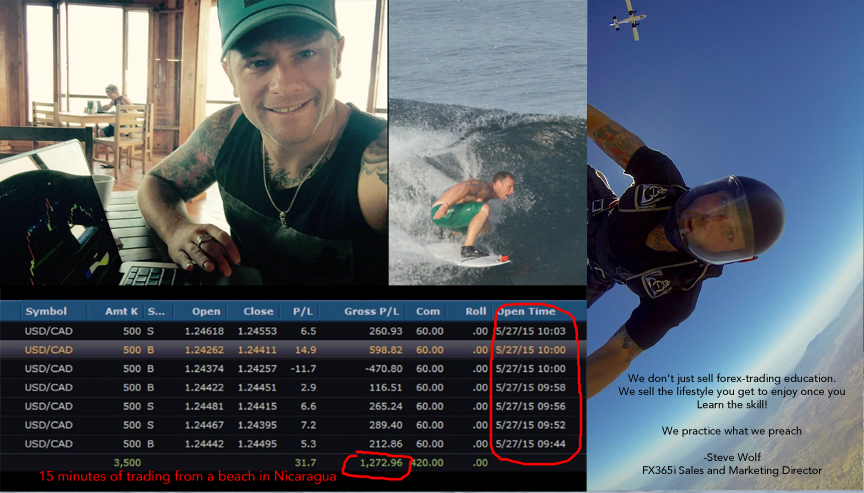

How I made $1,200 in 15 Minutes from a beach in Nicaragua

It is not everyday that you really get to feel all of your hard work pay off. When I started currency trading 3 years ago, it was hard. There was...

by Steve Wolf

17 Ways to Get Free Advertising for Your Business

When you work at a small business with a limited budget, it’s not really possible to shell out $340,000 for a 30-second TV commercial, or by Steve Wolf

Your Cheat Sheet for Posting GIFs on Instagram

GIFs are fun, digestible, and, most importantly, relatable -- which is why everybody loves them and shares them on social media so much.

Additionally, since Instagram is the top...

by Steve Wolf

E-commerce brands boost Facebook ad spend as CPMs, CPCs rise but CTRs dip

If the third quarter is a warmup exercise for e-commerce advertisers plotting their fourth-quarter spending spree, then it should be a happy holiday season for Facebook.

E-commerce...

by Steve Wolf

10 tips for choosing the perfect domain

Your domain name and URL play a big role when it comes to search. Not only is this the destination where your visitors will find you and your content, but...

by Steve Wolf

Digital Marketing for conventional Marketing as well as sales specialists

Infiltration has increased

Nevertheless, times have actually transformed and also all the mediums stated above have actually expanded in numbers. In addition, new networks such as websites as well as...

by Steve Wolf