by Steve Wolf | Dec 10, 2016 | Business

There’s little uncertainty Internet advertising and marketing is the best means to acquire additional exposure for any type of service. The keys to success are obtaining ample training to learn more about available methods; just how they function; and how you can interconnect them to take full advantage of on-line exposure.

Executing Web advertising strategies can be perplexing. There are dozens of options and methods which make it tough to determine which approaches are best suited. One of the easiest solutions is to deal with an on the internet advertising specialist.

Experts can analyze marketing strategies to determine which online techniques would enhance promotions already in location. They could supply advertising training courses to team member as well as assist in the development of a strategic advertising management system.

Maybe the best challenge of Web advertising is discovering time to handle several jobs. Almost everyone undervalues how taxing internet marketing is. Each approach could quickly be a fulltime job, so it’s essential to have sufficient staffing.

The bulk of organisation proprietors discover it advantageous to turn projects over to an on the internet advertising and marketing firm. While it can be a lot more costly to work with experts, the procedure of incorporating a selection of strategies will be quickened as well as the expense for training staff members could be removed.

< br/ > Owners that choose to enter this venue without expert aid will need to offer training in search engine optimization (SEO) and also Web advertising methods. It’s essential to get marketing training courses from individuals that have considerable experience and a strong track record of success.

There are training programs supplied for every single technique. Several of the much more preferred subjects include: Search Engine Optimization, web style, article advertising and marketing, video and podcast advertising, regional listings, web link structure, mobile advertising, and also social media sites marketing.

< br/ > Browse engine optimization need to go to the top of the list. Search Engine Optimization is used with all kinds of online content to inform internet search engine how material must be indexed. Lots of people find it much easier to find out Search Engine Optimization strategies in a class setting that offers communication with the teacher. Programs are available at regional universities, training workshops, as well as could be hosted at the office.

< br/ > Online video clips are a popular choice due to the fact that they usually go viral. Video clips could transform a business right into a home name overnight, so it is wise to require time to learn how you can profit from this robust marketing technique.

Although creating video clips has actually been simplified by sophisticated technology, it’s ideal to leave advertising and marketing videos in the hands of experts. One alternative to reduce production costs is to collaborate with amateur videographers that wish to broaden their portfolio. One more is to collaborate with university student studying videography.

Making audio podcasts is another reliable marketing technique. Podcasts can be utilized to supply information to customers. This location is suitable for producing a Net radio show; product paid announcements; concern as well as response sessions; and sharing interviews with industry experts.

< br/ > Social media site advertising and marketing has transformed the way organisations involve with consumers. Social media platforms enable owners to engage with people in a relaxed and also pleasant atmosphere.

< br/ > Social advertising supplies unlimited opportunities for getting to the masses. Participating in social marketing could be rather time-consuming, so it’s essential to develop a strong strategy and also have adequate staffing onboard to maximize possibilities.

These techniques are the basics of Internet marketing. Incorporating numerous strategies could be a massive job, but creating a strategic marketing plan as well as support team will aid company owner accomplish their objectives as well as improve sales earnings.

by Steve Wolf | Nov 30, 2016 | Business

A CRM or Client Connection Administration option is certainly among the crucial demands for any kind of organization. Hence, it is the most effective time for SMEs to properly release it in their system to reap its benefits, with the aid of a CRM Growth Firm. Picking a CRM solution doesn’t complete the task instead it initiates the task of choosing a release method. The deployment technique for a CRM option could either be organized Software application as a Service (SaaS) or on-premise where managers appreciate the freedom to hold the CRM remedy themselves. Generally many CRM remedies could be limited to one release approach so it is very vital to figure out the most effective release method for your CRM options: Software program as a Service (SaaS) or On-premise.

–

Enterprises, whether little or big require different levels of control for implementation of CRM service. Both cloud-based SaaS and On-Premise implementation methods have their very own advantages. You have to recognize your needs, before choosing a CRM Growth and Deployment version. Typically, cloud-based SaaS releases the employees to concentrate on deployment instead they could concentrate on other core features. The web server parts are taken care of by product specialists. On the other hand, organizations trying to find the greatest amount of control over their CRM service can choose On-premise deployment methods. This is usually liked by many organizations considering that it enables business owners to maintain the control within their intranet only.

–

Here are a few pointers that could help you make a decision in between Software application as a Service (SaaS) or On-premise deployment approach. Nonetheless, you need to employ a CRM Development Firm, which could lead you in the selection process.

1. SaaS could match your requirements if your organization doesn’t have sufficient internal staff and also equipment support, whereas On-Premise could work better if you have appropriate internal team as well as assistance to deploy CRM option. In instance of On-premise deployment method, internal IT personnel job on all functions of deploying a CRM solution.

2. SaaS can fit your company if you are searching for an implementation method for a short-implementation amount of time. For this, the company will have to pay month-to-month software application charge.

3. SaaS is best for your company if you’re looking for a release approach which doesn’t need a huge ahead of time investment instead requires regular monthly payments. On the various other hand, On-premise implementation technique calls for ahead of time settlement with long-term expense advantages.

4.On-Premise functions best if you need huge customization to support your company procedures as well as have information accessibility has to sustain various other applications, such as ERP. On the other hand, SaaS doesn’t sustain substantial customizations.

How you can choose? Considering that both implementation techniques a

re advantageous so the significant concern is that ways to choose the ideal. You could begin by identifying the protection and control demands of your organization. Besides this, the following step is to establish the IT personnel that will certainly be dealing with CRM solution and their availability. One huge consideration is to determine your CRM Development version the financial investment demands of the organization; whether the company has the ability to make big upfront investments or locate a monthly software charge is better.

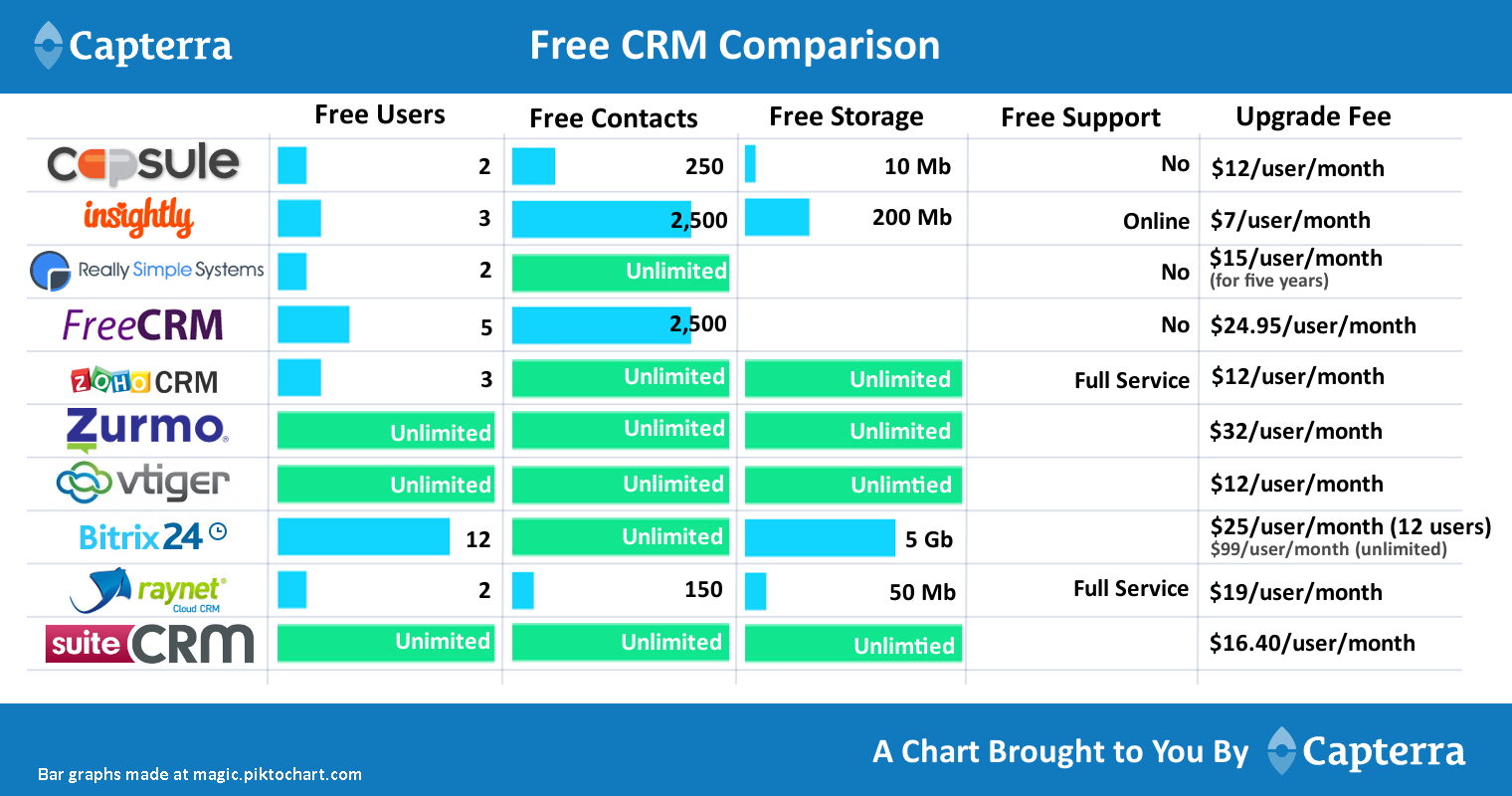

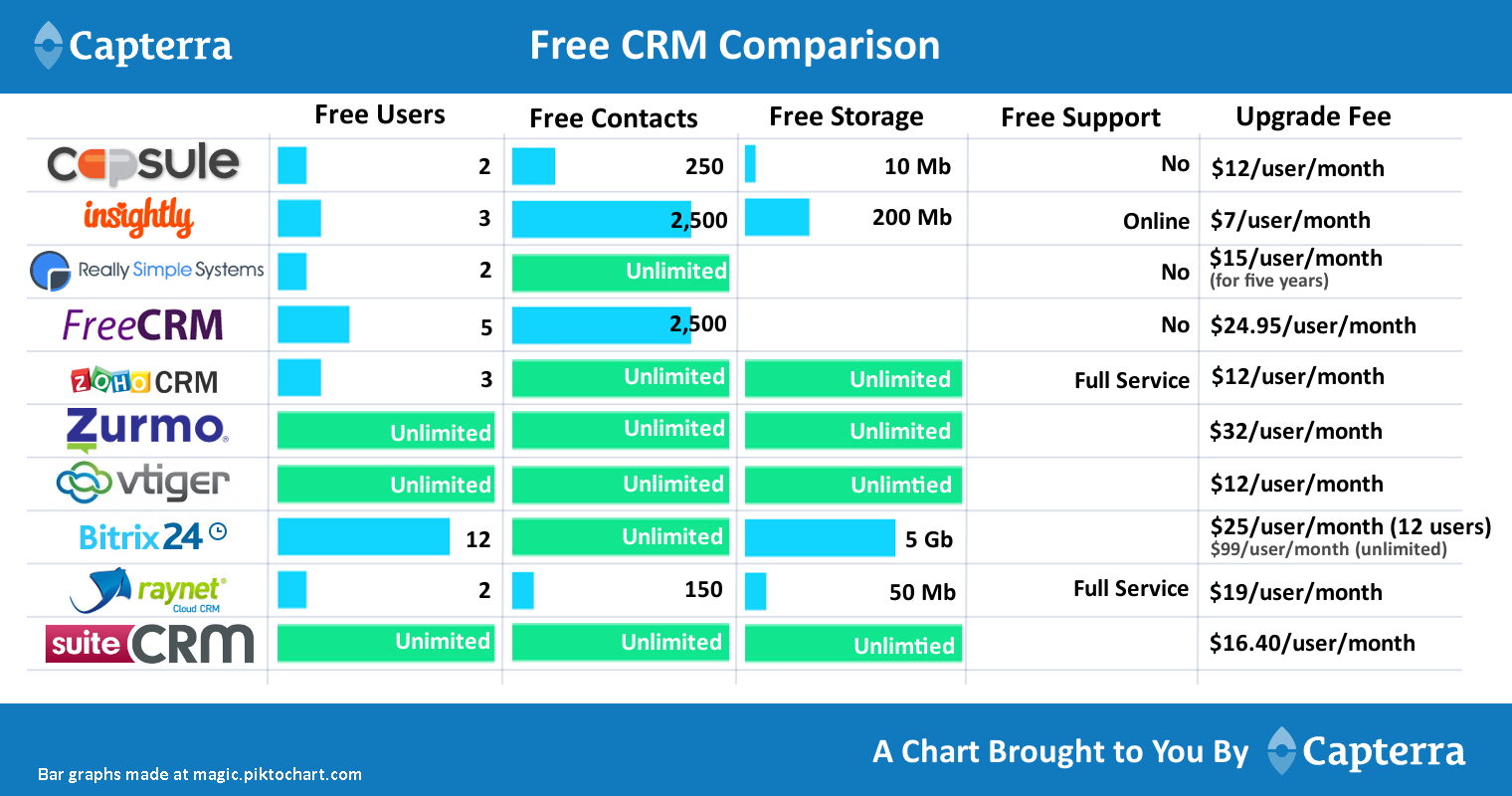

For me, I want a CRM that sales people will actually use. These days there are a lot to choose from. For me, I want something that is simple, and ready to go with integrations I actually carte about right out of the box.

Base CRM has been the answer to the solution for me and my team over the past 3 or so years. If you need a high level enterprise solution like Sales Force, ok great, but get ready to Drop 20k on set up costs, 100 working man hour on set up and then good luck getting you sales team to actually use it. But if you need, you gotta do what you gotta do! Check it out by

clicking here or on the picture below.

clicking here or on the picture below.

Either way, choosing correctly and taking your time will be the best decision you will ever make in choosing a CRM for your company!!!

by Steve Wolf | Nov 12, 2016 | Business

The Center for Sales Strategy – Sales Strategy Blog

I am really good at showing up on time, coaching people, planning jam-packed vacations, coming up with creative gift ideas, and breaking down something complicated into the key points that everyone needs to understand. Those are my talents—the things that I do well. Maybe even better than others. And, if I really thought about it, I could probably even think of a few more things to add to my short list.

Now, ask me to make a list of things I’m not very good at—the things I’ve worked hard at but never seem to be able to do as well as others…. Well, that could go on all day! Playing tennis, building budgets, writing in straight lines on a white board, singing in tune…. Seriously, I could fill the page! While practice might make me a bit better, I will never achieve greatness.

And as much as that bugs me, it’s pretty normal. We all have strengths but we have MANY more weaknesses than we have strengths. And that’s okay, because no one succeeds based on their weaknesses.

Just some thoughts!

by Steve Wolf | Oct 13, 2016 | Business, Lifestyle, Money

I wrote a previous blog on money management where I shared some tips on how to identify where you are wasting money and then gave my own personal formula (via an downloadable excel spreadsheet found here) the gauge all of your spending. If you are coming from that blog, then you are in the right place. If you are just looking at this blog for the first time, it may be prudent to go back and check out the previous one I wrote or at least download the excel spreadsheet because you will need it for the next step.

Step 2 – Formulating a simple budget that you will actually follow.

It was told to me early on in life by a very wealthy mentor of mine who I respect dearly that if I couldn’t manage $1, then I couldn’t manage $1 Million dollars. This is so true, I meet people all the time who’s personal finances are garbage even when they are making great money in their career.

It all comes down to money management and budgeting. Again, this is another common thread among all wealthy people I have ever met; they all have a budget based on a formula that uses money as a tool never spending it emotionally. Here is what to do.

Take that excel spreadsheet you just downloaded. (or get it here)

The idea here is very simple. Manage any and all money that you get. EVERY SINGLE CENT! If you know what your monthly income is, it becomes very easy to budget, if you are like me and get paid in lump sums sporadically then disciplining yourself to a system like this is crucial!

Ok so here is how it works: For every dollar I take in, it gets split up and put in to different bank accounts. Each bank account represents a different aspect that I am saving for. In my case I have 8 Bank accounts. I explain what I use them for and the benefits.

- Wells Fargo Checking / Savings account – This account is used for daily spending, and paying bills. Think of it as your most active account, all money is deposited here before it goes to other accounts.

For daily spending and bill payment, I like Wells Fargo. The important thing to remember here is to bank with a bank that is convenient to for you with lots of locations and low fees across the board. As of right now, I pay NO FEES with Wells. I think B of A is the worst, and Chase Bank is in the middle when it comes to big banks.

- Discover Bank # 1 – Taxes (This is where I said aside money for taxes every year)

- Discover Bank # 2 – Emergency Fund account (Save for a rainy day)

- Discover Bank # 3 – Long Term Savings (Use for large purchases like a house or car etc.)

I use Discover bank because they give you the highest rate of return for a savings account. 0.95% to be exact and…

- No minimum deposits

- No Account Fees

- Open as many accounts as you want

- Capital One 360 # 1 – Annual Expenses account (Money set aside for annual expenses like car insurance, property tax etc.)

- Capital One 360 # 2 – Vacation Fund (Saved money for Vacations)

I use Capital One 360 because they pay a pretty good rate of return on money in savings and my account doubles over as my top pick for a travel debit card that has

- No minimum deposits

- No Account Fees

- Open as many accounts as you want

- NO foreign transaction fees

- No ATM banking fees.

(If you are interested in opening up a Capital1 360 Account and want $20 for free just for doing so, click this link.)

- Wealthfront Account – Managed Portfolio Long term investing account

(Click here to learn about wealth front and why I recommend them. Clicking this link will get your first$15,000 managed for FREE!!)

- FXCM Account – This is my active foreign currency trading account as I trade currencies daily. If your are interested in learning how to trade I wrote a blog about it here, otherwise, dedicate the 5% I am setting aside in this account to some other find or investment.

Now take some time to look it over the excel spreadsheet. If you need to open a couple accounts, don’t worry, this can literally be accomplished in an hour, follow the links above to use my recommendations, or feel free to open up accounts where your want to.

Keep in mind that I am a 1099 independent contractor that means I pay my own income taxes each year. If you are a W-2 employee, then you can zero out the taxes line because your taxes are collected before you get paid. Personally I set aside 18%-20% a year for myself, you may pay less or more depending on how much you make and what your tax liabilities look like.

- Enter all of your monthly and annual expenses. (You will see some numbers starting to populate)

- Replace my bank accounts with your banks and match them closely as possible, meaning if you have a normal B of A or Chase Checking and savings account, that should be your main account at the top. If you have an E*TRADE, Schwab or IRA, replace my Wealthfront account with yours etc.

- If there are some areas where you will need to set up new bank account, leave them blank for now

- Now enter in your monthly income at the top in the yellow (total monthly Colum)

- By now you should see some of the boxes populating. I will explain what’s happening here

The Breakdown.

Ok by now you probably have a good idea of what I am driving at here, but I will explain anyway. This formula is partitioning all of your income into different savings columns to give you a well rounded and financially savvy money management system.

The breakdown as seen in my excel sheet looks like this.

- I earn $100

- $20 (20%) is saved for taxes and taken right off the top (Skip step if you are a W-2 employee)

- Now I have $80 Left

- $40 (50%) Goes to my living expenses, i.e. rent, mortgage, car payment, food, gas etc.

- $10 (10%) – To the emergency fund, after all shit happens.

- $10 (10%) – Long-term savings fund. This could be for a future large purchase like a car or house down payment.

- $8 (8%) – Annual Expenses Account – Like car registration or medical/life insurance. Things that get paid once per year

- $7 (7%) – Vacation Fund – To broke to take a vacation, do this for a year, and I promise you that you will have enough to take a vacay!

- $10 (10%) – Long-term investment account – YOU NEVER TOUCH THIS MONEY! This is for your retirement. You may be thinking I’m way to young to start saving for retirement, but the difference between starting this habit at 20 years old compared to 30 years old will mean a difference of hundreds, yes I said hundreds of thousands by the time your retire. So don’t fuck around with this one, set the 10% aside and forget about it.

- $5 (5%) – For me it goes to an active trading account that I personally trade. If you have no desire to learn how to actively trade, you can simply put this money towards some other kind of investment short term to medium term, but this money is not for bullshit, it’s money set aside for short-Medium term investments with a bigger return on the short side.

Conclusion

This whole idea was adopted after first reading the age old book The Richest Man in Babylon. When done correctly you will learn to pay yourself first and then save and invest the rest of it leaving a little hear and there for having a good quality of life.

My parents generation saved about 20%-30% of there income on average. My generation saves a measly 5%-10% and knowing that we are going to need a least a cool million to retire on (4 times as much as my parents will need) we need to get on this today. There is literally no time to waste.

Again, if you are in debt, or not making a lot of money, apply this formula anyway. Rework the numbers to make them fit your situation. If you are in some serious debt, check out my blog on &^%&^%&*^%&* if you are just not making that much or spend money stupidly, then I challenge you to try this for 90 days. If after 90 days you don’t feel like you have a better handle on your finances and that you are heading in the right direction, comment here and I will jump out of an airplane to promote what ever you want me to.

Money is a tool. It is only emotional when you don’t have enough of it. It controls you, or you control it, simple as that.

****And as a bonus, if you are still not convinced, Acorns is a nifty little app that allows you to invest pocket change from rounded up expenditure in to the market as a long term investment. Follow this link to check it out and get $5 for opening an account.

Did you mis part 1 of this blog? Read it here!